Share this Case Study

How MEGHNAD Insights Helped Optimize the Early Ownership Experience of a New Lifestyle SUV

Client Context

A leading automotive OEM launched a new lifestyle SUV, expanding its portfolio with a product designed to offer a versatile driving experience.

The Challenge

Despite strong market enthusiasm, the OEM needed clarity on how the new model was performing in the real world compared to established competitors in the segment. They faced critical information gaps regarding:

- Validating the Lifestyle Promise: Determining whether the actual ownership experience matched the advertised positioning, particularly regarding interior quality, cabin comfort, and technology.

- Early Dissatisfiers: Identifying specific quality or performance issues (e.g., infotainment glitches, ride comfort) that could damage long-term brand reputation.

- Competitive Benchmarking: Understanding how the ownership experience compares against established rivals, specifically regarding service standards and feature reliability.

The client commissioned feedback calls with early adopters and partnered with InXiteOut to analyze this feedback, aiming to strengthen product-market fit.

The InXiteOut Approach

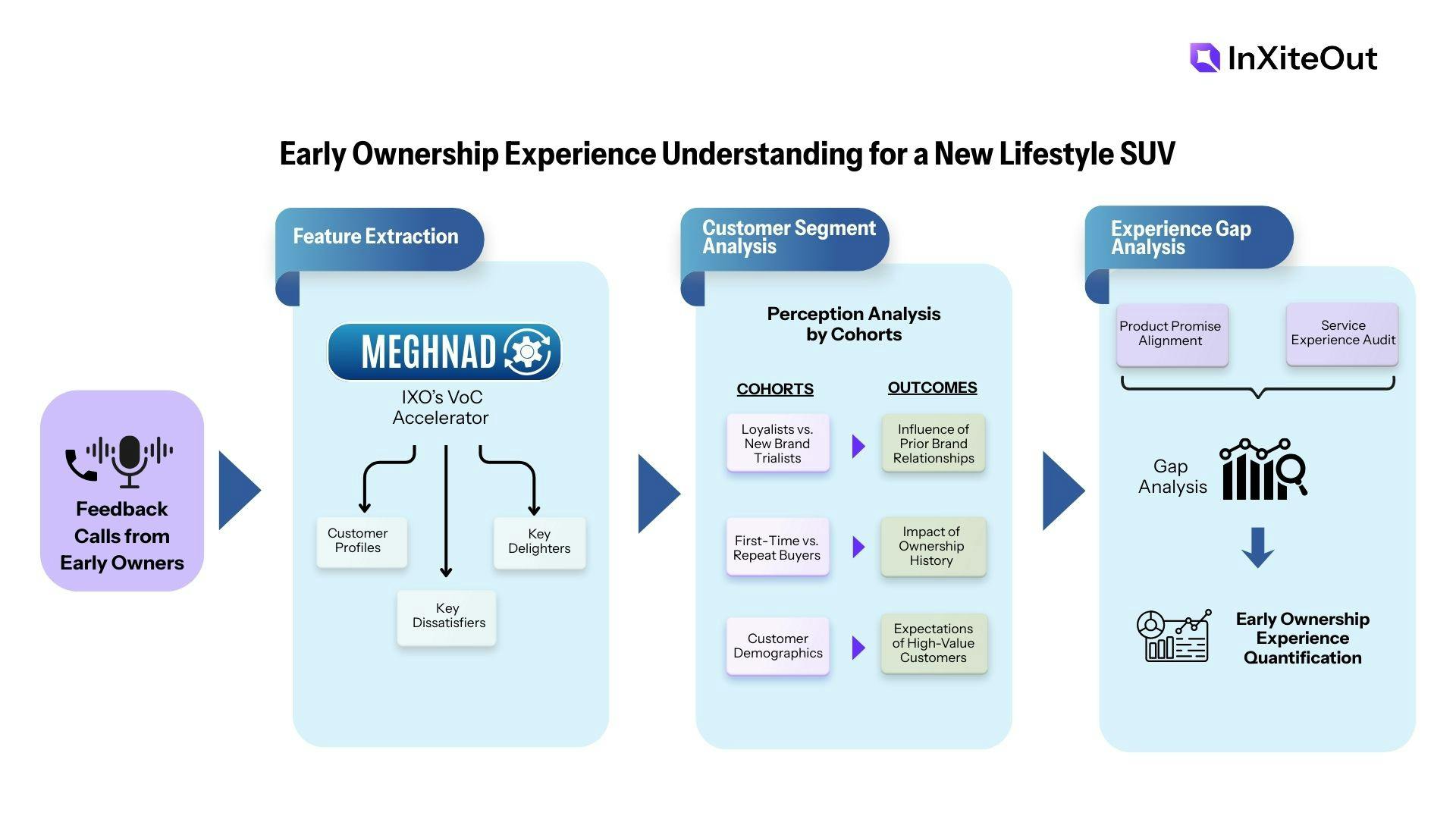

We analyzed feedback from early owners across different variants, geographic zones, and customer segments. The analysis leveraged MEGHNAD, our proprietary VoC intelligence accelerator, and followed a detailed three-step process:

MEGHNAD-based feature extraction

We leveraged MEGHNAD to process the feedback calls and automatically extract a comprehensive view of the customer and their experience.

- Customer Profiling: We captured the specific profile of each respondent, including their demographics, occupation, existing car ownership, and prior engagement with the client’s brand.

- Key Delighters: We isolated the specific attributes driving positive sentiment to understand what customers liked most (e.g., road presence, performance).

- Key Dissatisfiers: We tagged specific friction points to understand areas for improvement, identifying recurring issues like infotainment lag or cabin vibrations.

Customer segment analysis

We moved beyond aggregate perception to perform a comparative analysis across three strategic cohorts, aiming to pinpoint exactly where expectations varied:

- Loyalists vs. New Brand Trialists: We compared existing brand owners against those new to the brand to understand how a prior relationship influenced the customer's perception and tolerance for initial quality issues.

- First-Time vs. Repeat Buyers: We differentiated between first-time car buyers and experienced owners to assess how prior ownership history impacted expectations regarding dealership standards and vehicle refinement.

- Customer Demographics: We segmented users based on the variant purchased and their prior vehicle ownership to determine if the experience was meeting the elevated standards of the brand's most upscale, high-value customers.

Experience gap analysis

Finally, we established two critical areas of competitive and qualitative benchmarking to measure the ownership experience:

- Product Promise Alignment: We mapped customer feedback related to interior quality, technology, and cabin comfort directly against the brand’s intended positioning. This process determined the specific tangible product features that successfully supported the aspirational image, and those that failed to meet that standard.

- Service Experience Audit: We audited the end-to-end customer journey, spanning from the initial walk-in at the dealership, through vehicle handover, to the first service appointment. We benchmarked this entire experience against the vehicle's price point and the standards set by competitor brands.

Technology stack used

- MEGHNAD, IXO’s VoC Accelerator

- Azure ETL Platform

Benefits Delivered

The insights enabled the client to take specific strategic actions to strengthen the product and ownership experience:

- Prioritized Critical Quality Fixes: The analysis isolated high-impact dissatisfiers, prompting the client to accelerate software patches for infotainment stability and address hardware concerns.

- Refined Interior Utility Strategy: Validated that while the design was appreciated, the practicality was lacking. This guided short-term updates for interior options suited for Indian conditions and created a long-term roadmap for better interior utility storage.

- Highlighted Gaps in Service Ecosystem: The analysis highlighted critical gaps in the service ecosystem, revealing where standards (e.g., overbooked centers, poor delivery transparency) were lagging behind customer expectations. This provided clear, data-driven levers to upgrade the entire ownership journey.

Suggested Reads

Unstructured Voice to Strategic Insight: How InXiteOut Powers an Automotive Leader's Customer-First Strategy

Discover how InXiteOut transformed unstructured voice data into strategic insights, enabling a Fortune 500 automotive leader to accelerate customer-first decisions.

How MEGHNAD Insights Helped Optimize the Early Ownership Experience of a New Lifestyle SUV

Learn how MEGHNAD Insights empowered a top automaker to enhance SUV ownership quality, resolve early issues, and deliver a superior lifestyle experience.

How AI-Driven Insights De-Risked a Critical Design Change for a Global Auto OEM

Find out how AI-powered VoC analytics helped a global automotive OEM de-risk a major fuel tank design change, safeguarding sales and improving product decisions.